Company infomation

Founded in 1992, Huaxia Bank is a national joint-stock commercial bank headquartered in Beijing. It made its first initial public offering and went public for trading in 2003, becoming the fifth listed bank in China. Dedicated to the mission of “serving the new era, building a new Huaxia”, Huaxia Bank provides specialized and comprehensive financial services to serve its individual and corporate clients. Currently, Huaxia aims to accelerate its digital transformation and help improve both quality and efficiency of the real economy.

- Industry: Banking

- Location: Beijing

- Official website: www.hxb.com.cn/index.shtml

Company representative

Huaxia Bank was eager to accelerate the digital transformation for all branches. The goal was to break down data silos and improve collaboration between departments, also cultivate our staff to be digital talents to cater the trend. However, we struggled to meet the goal because of limitations including personnel shortage. By adopting HAP, everything has changed.

——Vice President of Information Technology, Huaxia Ms. Yi

Pain point & challenge

Huaxia Bank has viewed digital transformation as a crucial strategic transformation approach since 2021. In the next year, five initiatives—including low-code—were implemented as guidelines to assist the bank in its transformation. Under this background, its IT departments struggled to respond timely to the growing demands from the entire bank, which went against the trend of digital transformation. Thus, a number of challenges arised:

Personnel shortage and tight schedule problem faced by IT department

With a relatively small team setting, Huaxia’s IT department was in charge of development and network maintenance work for the entire bank, which included more than 100 branches. Ever since Huaxia Bank started the transformation, its IT department started to feel frustrated in processing with needs that keep coming, resulting in unfinished jobs kept stacking up. What Huaxia aims to achieve is far more ambitious than completing the unfinished jobs piling up, but equip its staff with digital skillset and structured thinking ability to prepare for the future.

Insufficient collaboration between departments

Another issue needed to be addressed is the lack of collaboration inside the bank due to the separated storage of data by various departments. Huaxia bank is keen to revolutionize by combining information technology with real business cases to establish an sustainable ecological chain.

Implemented green office program within the entire bank

Huaxia also wished to respond to the ESG recall by cutting back on paper-based procedures like manual ledgers as much as possible. A sore point during the Covid-19 outbreak has always been the need to streamline the internal approval process and reduce bureaucracy. By reducing manually input and paper-based procedures, the bank would definitely increase processing speed and streamline operations by decreasing human input and paper-based processes.

Huaxia Bank acknowledged HAP for its sophisticated product capabilities and extensive service support after the IT department assessed a range of popular No-code APaaS solutions. In the end, Huaxia chose to settle on the HAP.

Solution

Quote from a non-tech staff of Huaxia: At first it was curiosity, then confidence was built when you see something you made could bring real productivity. Now it is an addiction to make more and more!

Based on the challenges faced by Huaxia, we quickly identified and proposed a systematic plan centered on HAP.

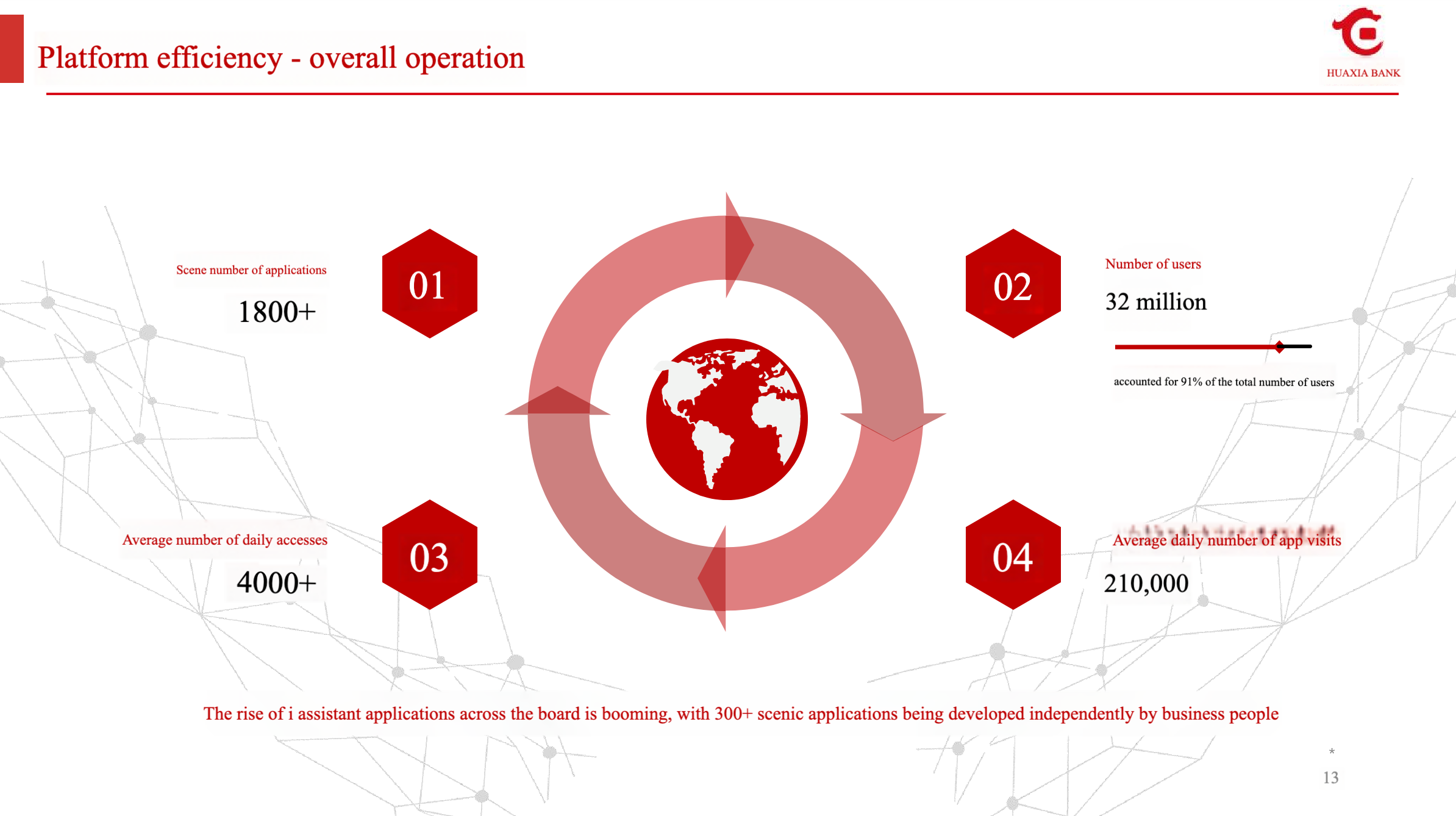

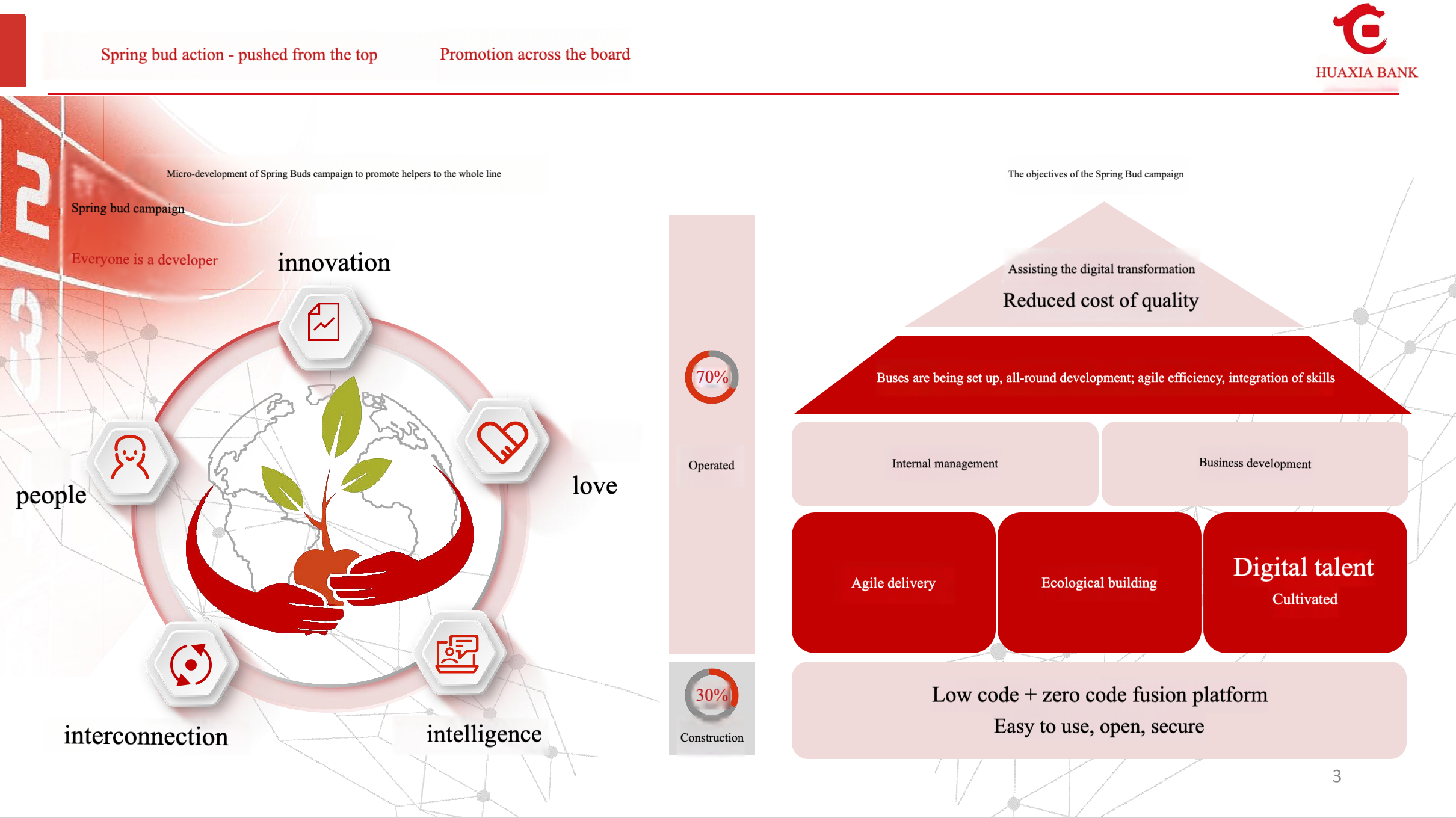

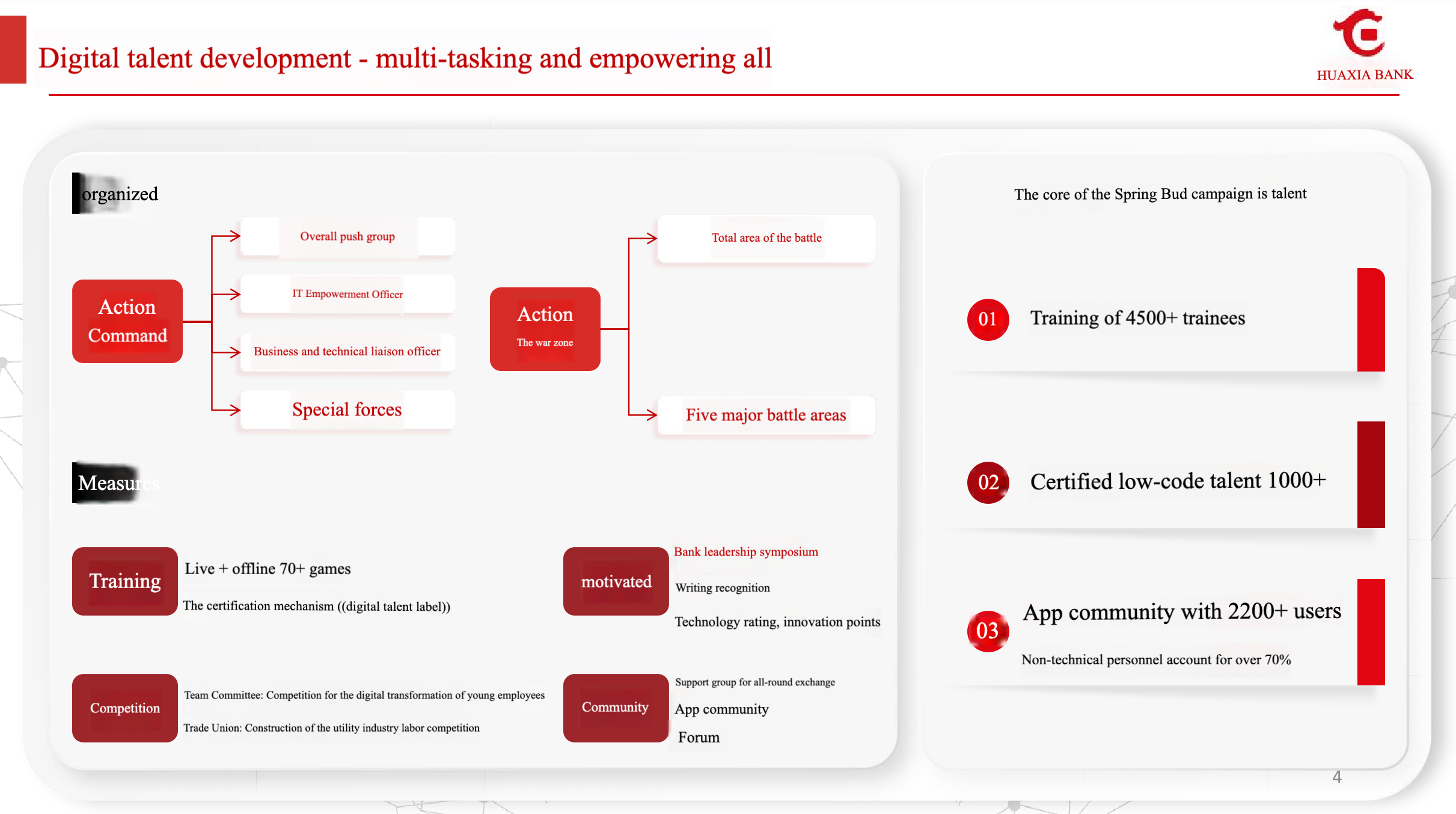

Implement digital talent development program

A systematic digital talent development program was specifically created to support the bank’s efforts to cultivate digital talent. More than 4,500 workers benefited from the more than 70 training sessions we assisted Huaxia Bank in holding up until 2024. As a result, Huaxia Bank today has more than 12,000 internal users utilizing HAP, and more than 1,000 low-code developers who can create useful apps using the tool. The bank developed over 800 applications, with an average of over 2,000 users every day.

Training time for non-technical workers was significantly reduced by HAP’s low threshold and smooth learning curve. In the process, Huaxia employees develop a structured thinking mindset in addition to learning digital skills to handle various kinds of situations, and perform better in integrating daily business with technology. According to Ms. Yi, Huaxia Bank employees under 40 must possess digital expertise, which is a critical criterion for internal promotion. Additionally, a low-code forum and internal community were established to create a favorable atmosphere and allow employees to freely discuss and share learning experiences. “By lowering the threshold, everyone can be a developer, ” Ms. Yi stated.

Enhance collaboration and efficiency with cost reduction

HAP supports docking third-party systems and WeChatWork, hence helping break down data silos and improve OA collaboration. All major business areas are covered by Huaxia Bank’s non-technical employees, who must collaborate with one another in the head office, branches, subsidiaries, and sub-branch outlets. The previous barriers caused by separate storage of data by different departments are now cracked by using HAP. Just as Ms. As Yi mentioned, HAP speeded up the whole digital transformation centered on internal management and business development. We are now proud to announce that we achieved both quality improvement and efficiency increase with a surprising cost reduction!

Answer the ESG call and build a green office

Traditional financial industry has always been one of the most cautious and most loyal users of HAP. With extremely sensitive personal data and stringent requirements on data security and compliance standards, HAP helped Huaxia Bank convert a significant amount of its paper-based procedures to electronic ones. Not only are manual ledgers now totally canceled, several key internal approval processes have been shifted to the HAP platform.

Key achievement

- Held 70+ training sessions, benefited 4500+ employees and 1000+ low-code developers

- Currently there are 12,000+ internal users , 2,000+ daily users on average, 800+ applications being put into use

- Built a precision marketing system to enhance customer acquisition, customer activation and customer retention

- Implemented green office program within the entire bank, and reduced paper-based processes such as manual ledger

- Further explored in data-driven management methods to improve operational efficiency