Summary

In 2020, the Technology Department of the People’s Bank of China(PBC) mandated that financial institutions at all levels submit technology information categorized into 59 categories and over 2,000 attributes, each subject to strict data verification rules. Using traditional coding development would require an investment of approximately 18 person-months.

However, Uino, a partner of Nocoly, completed a demo of the technology information submission system in just 2 days with a 3-person team; developed the first operational version in 7 days; and officially provided this system and service to 50 banks within 30 days. Ultimately, over 100 commercial banks in China have adopted this solution, significantly improving the efficiency of financial technology information submissions.

Introduction

The PBC, which serves as the central bank of the People’s Republic of China, was founded on December 1, 1948. As a key component of the State Council, it is responsible for formulating and implementing monetary policies, overseeing the issuance and circulation of the currency, and ensuring the stability of financial markets. With the evolution of China’s economy, the PBC has become increasingly vital in the country’s macroeconomic regulation and financial supervision.

Challenges

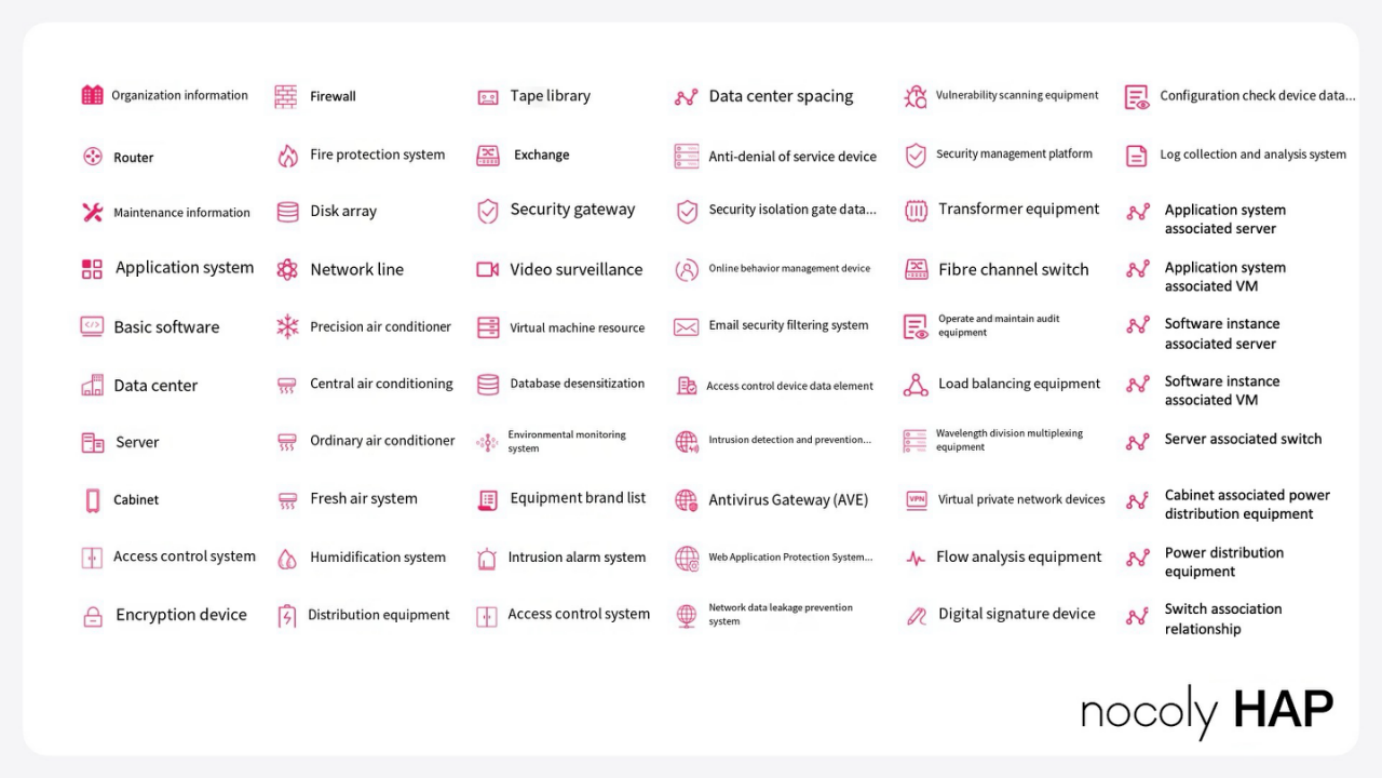

In 2020, the Technology Department of the PBC mandated financial institutions at all levels to submit all information about IT hardware and software to a dedicated information management system of the PBC. They mandated the reporting of data across 59 categories and over 2,000 attributes. Each attribute has strict data verification rules, and the submitted data must first pass checks for Completeness, Uniqueness, Timeliness, Validity, Accuracy, and Consistency.

This policy has driven the PBC and commercial banks in China to seek more effective, accurate, and secure digital solutions for financial technology information reporting. However, the implementation of this solution is not easy, and it faces the following challenges:

- Data Collection

Data that commercial banks need to submit is abundant and scattered, which requires them to invest a lot of effort in data integration, access and other work.

- Quality Control.

Many financial institutions have not met the submission requirements (such as data integrity and normalization), so the PBC requires a lot of costs to carry out data verification, proofreading, and supplementary recording.

- Code Conversion

Data submission must follow 1,830 coding rules, which means a large number of coding conversion programs need to be developed under the traditional development model.

- Anomaly Detection

Various issues may arise during the process of submitting to the PBC, such as interface communication failures, DataType errors, configuration errors, coding anomalies, etc., making it quite difficult to detect the anomaly.

Solutions

Multiple Data Submission Channels

Due to the significant differences in the level of information technology among banks, in order to ensure that the solution is applicable to all the banks, the system offers multiple data submission channels: (1) Manual entry; (2) Import Excel templates; (3) Integration with third-party systems such as Configuration Management Database(CMDB) and Asset Management System. By providing various data submission channels, Nocoly HAP conducts automatic verification of the data to ensure compliance with standards and addresses the challenges of data collection.

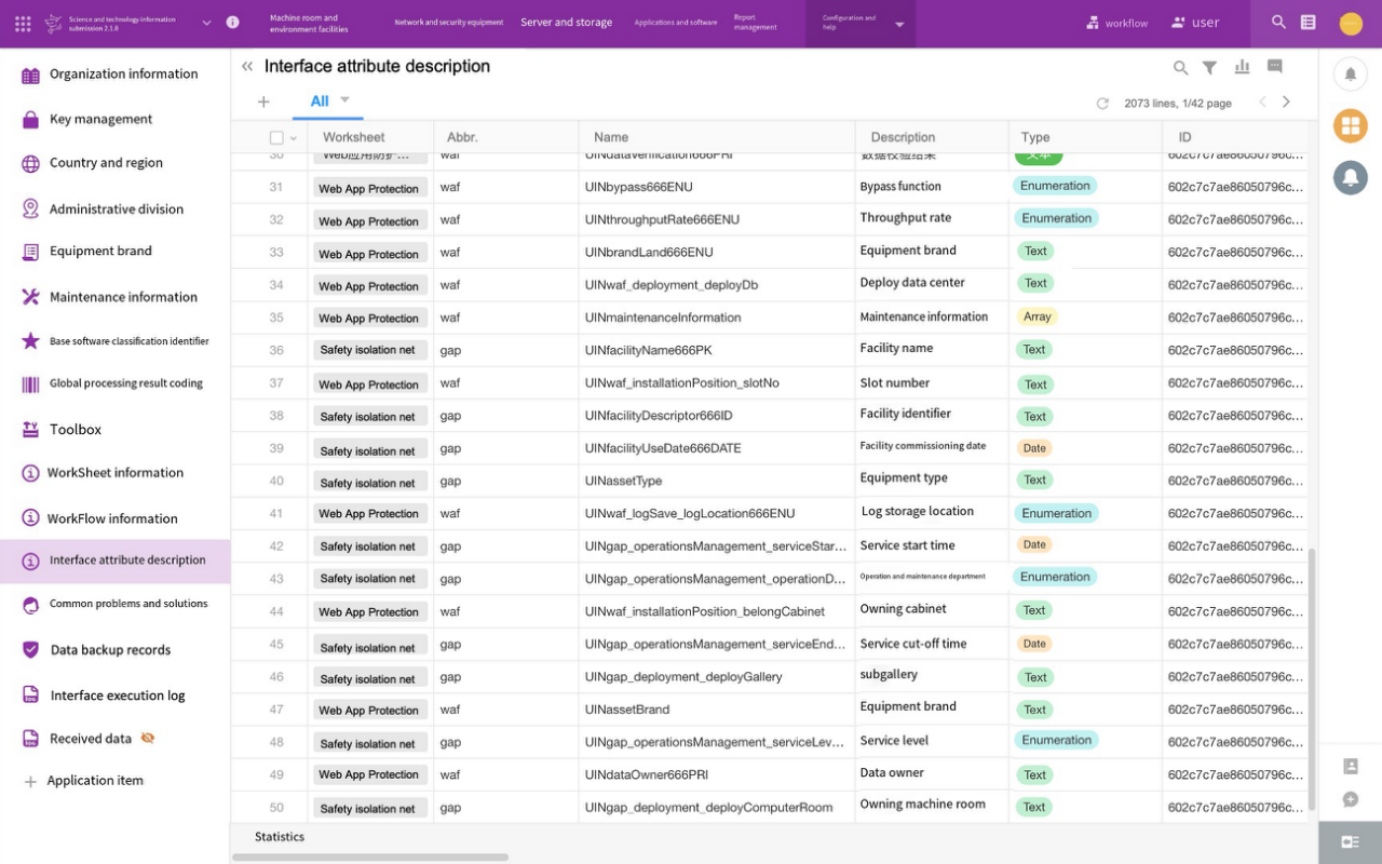

Data Verification Rules for Massive Data

To tackle the challenges presented by the complexity of data verification rules, the system is equipped with 2063 verification rules that cover 59 categories of IT assets, including data centers, air conditioning, power supply facilities, cabinets, servers, storage, and networks. This setup guarantees that the reported data adheres to submission standards. Furthermore, it features a built-in reporting interface, allowing commercial banks to utilize it at once.

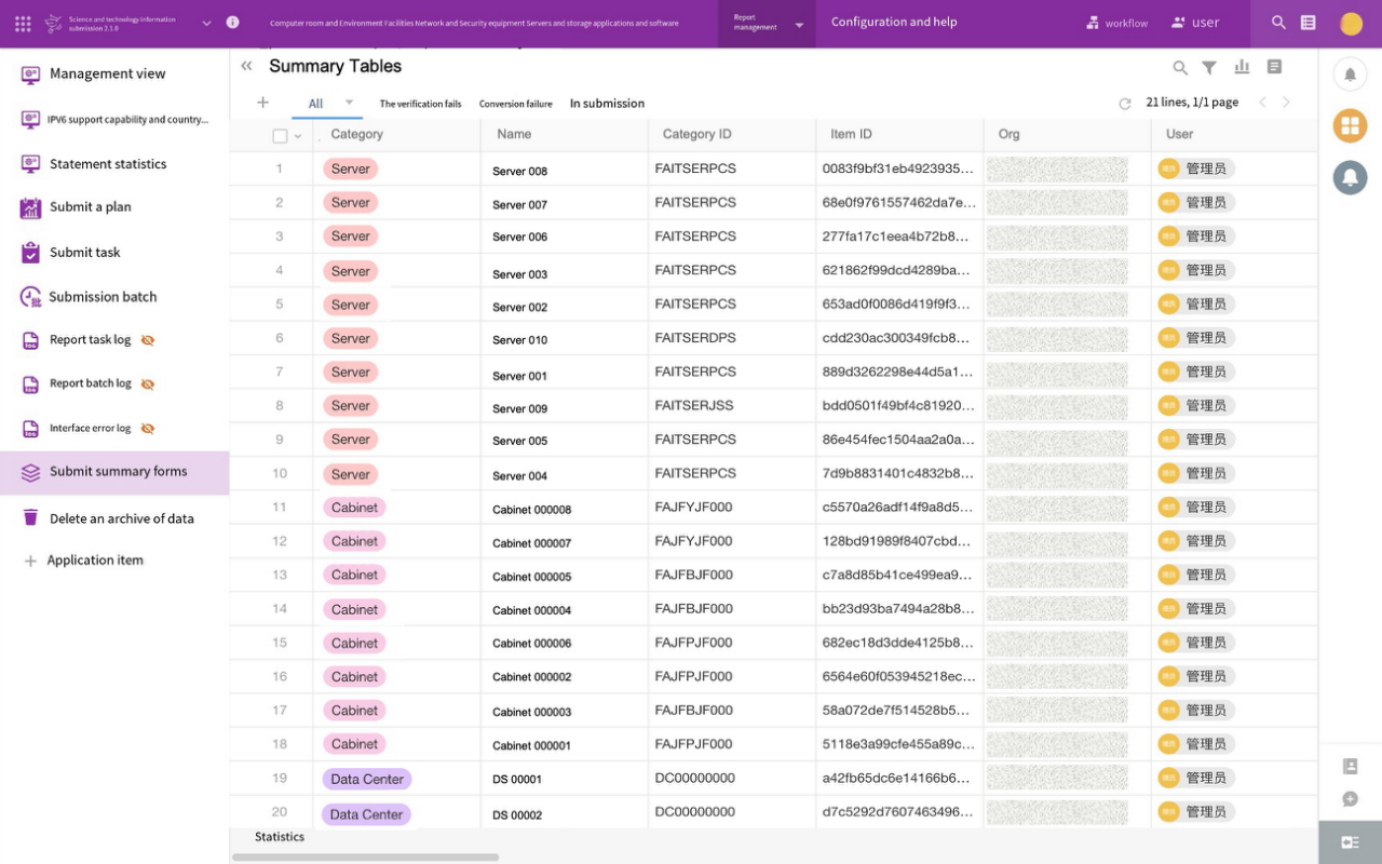

Full Data Submission, and Real-time Monitoring of Anomalies

The system generates one or more submission batches automatically based on the volume of data, and once the submission batches are sent to the PBC, data verification takes place. If the verification fails, the system will return the failed submission batches to the system, and the submission administrator can check the status of the abnormal batches in the “Submission Batch” form. If the submission fails due to data issues, detailed reasons can also be found in the “Summary” form. After handling the abnormalities, the administrator can resend the data for the abnormal batches.

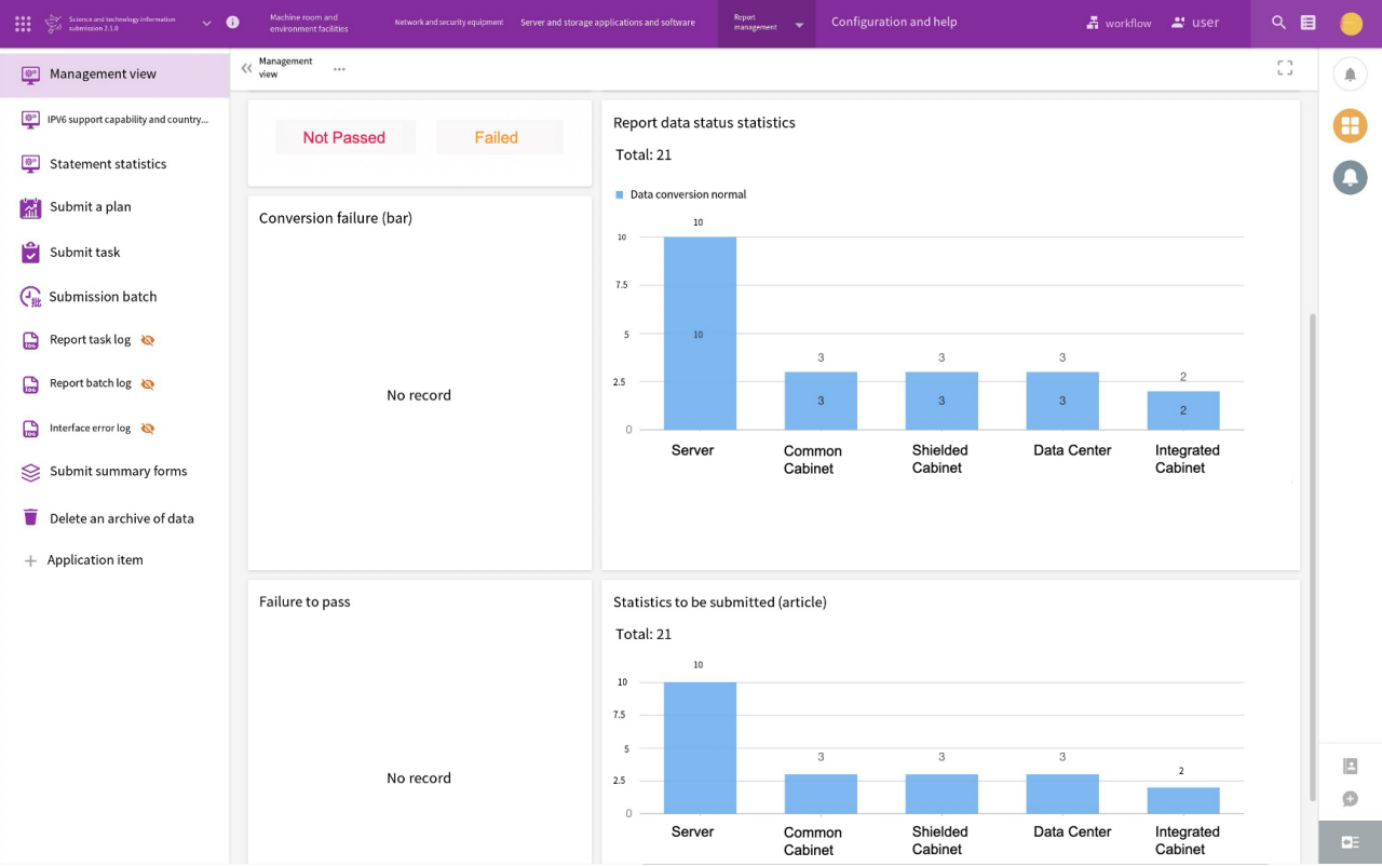

Multi-dimensional Data Dashboard

The system provides a flexible multi-dimensional data dashboard, including key data integrity rate, number of data quality issues, automatic discovery success rate, and automatic discovery coverage rate. In response to data quality issues, the system will automatically check the integrity and normalization of the entered data, and generate a visualization dashboard of data quality. The data administrator can also view the “Configure Data Operations Dashboard” to understand the specific problem data of the department and effectively solve the data problems.

Reduce Costs, and Private Deployment

In comparison to traditional development, using Nocoly HAP to build applications is more efficient in terms of time and labor. Additionally, Nocoly HAP allows for private deployment to be completed within one hour, enabling financial institutions to accomplish their submission tasks quickly and securely.

Key Achievements

- Ensure over 100 commercial banks complete Fin-tech info submissions on time & with quality

- Offer multiple flexible data submission channels, catering to diverse needs of banks

- Real-time monitoring of abnormal data, swiftly pinpoint causes, and enhance execution efficiency

- Reduce project costs, and alleviate budget pressures on banks

- Private deployment ensures data security for all banks