Sometimes, IT companies deliberately keep partnership details vague for PR purposes. More often, practitioners themselves do not fully understand the commercial significance of “Partnership” and the roles different partners play in business development and delivery. This has resulted in a scenario where “everything goes into one basket,” adding learning and understanding barriers for new industry entrants and reducing operational efficiency. This blog post aims to clarify the types and nature of partnerships in the IT industry, helping practitioners understand business models and improve operational efficiency. The classification method introduced here is not my invention but is based on decades of global enterprise software industry practices.

For any business, real transactions involve only customers and suppliers. Partners are not on the same level as these entities. In many cases, IT companies refer to some customers and suppliers as ‘partners’ because of their higher importance and more complex cooperative relationships compared to ordinary customers and suppliers. Some partners may not have economic transactions with the company but are developed to enhance the end customer experience and share customer bases.

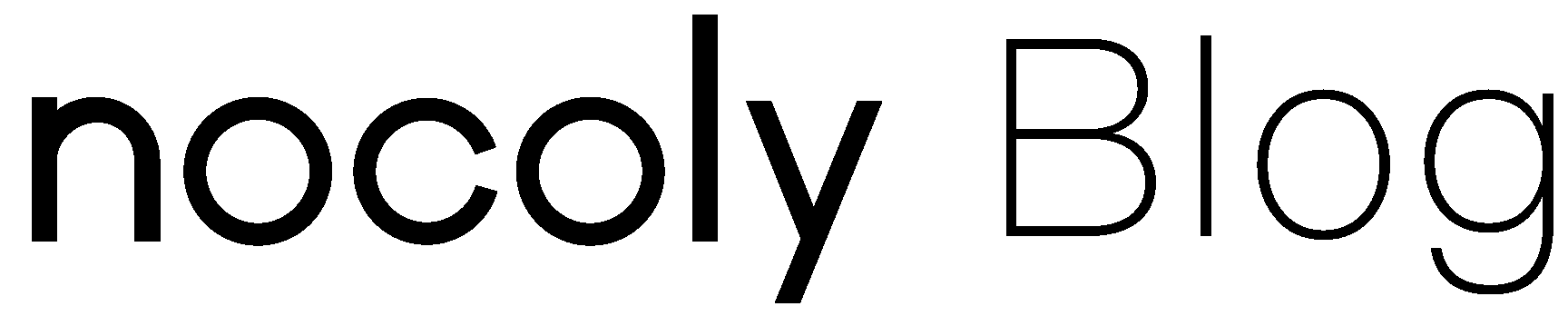

Value Added Reseller (VAR)

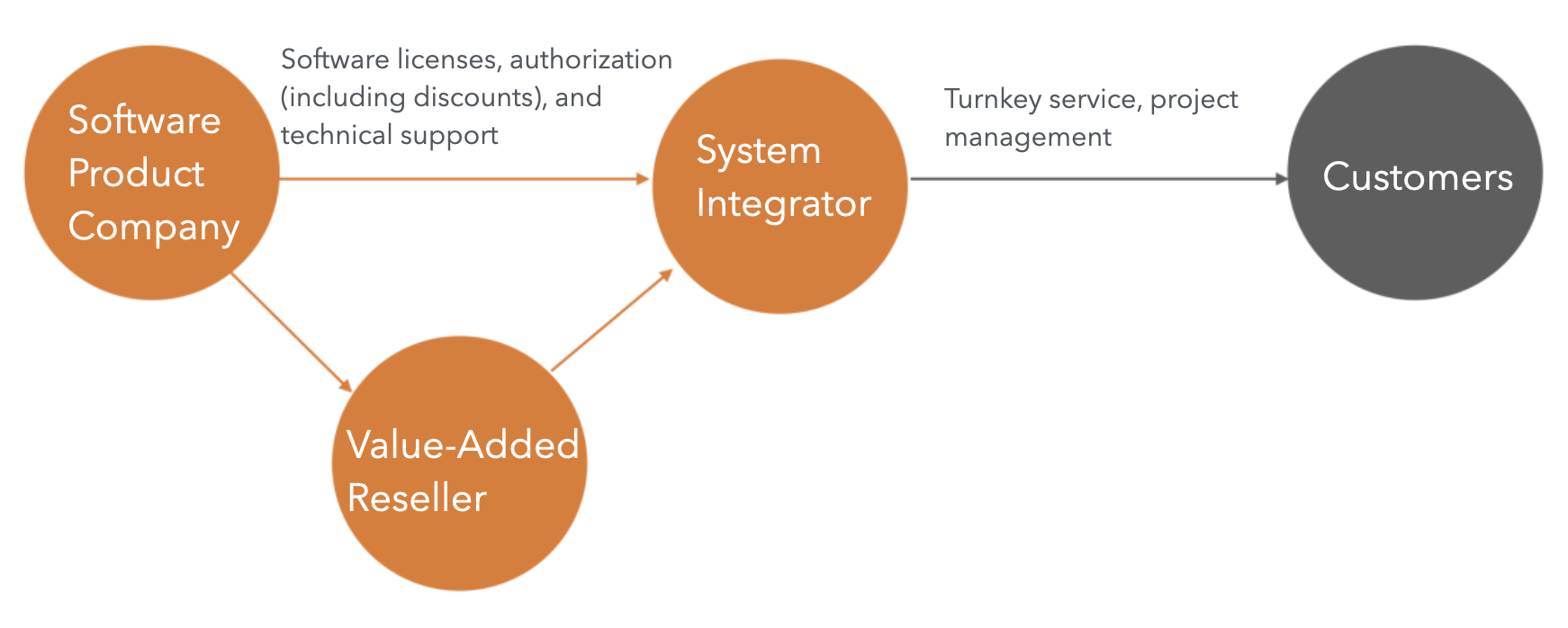

The VAR partnership is the most common form of partnership in the enterprise software industry. It is generally established between software product companies and value-added sellers. Value-added selling means that distributors not only distribute products but also add their own value in the process. Common value-added activities include consulting services, implementation, solution integration, and user training support.

Due to different value-added activities, these partnerships may be specifically named, such as Consulting Partners, Implementation Partners, and Solution Partners. Their essence revolves around a standard software product to add value and thereby gain a portion of the value chain’s revenue.

Software product companies prefer to establish these indirect business models due to the inherent complexity of the enterprise market. A general software product can serve businesses of different sizes and industries, but establishing true service capabilities requires vendors to establish sales branches in each region and acquire necessary industry knowledge. This task is unrealistic even for giants like Microsoft and SAP. Thus, they invest in developing and training partners, offering product discounts and value-added sales opportunities. For important end customers, product manufacturers are even willing to collaborate closely with value-added sellers.

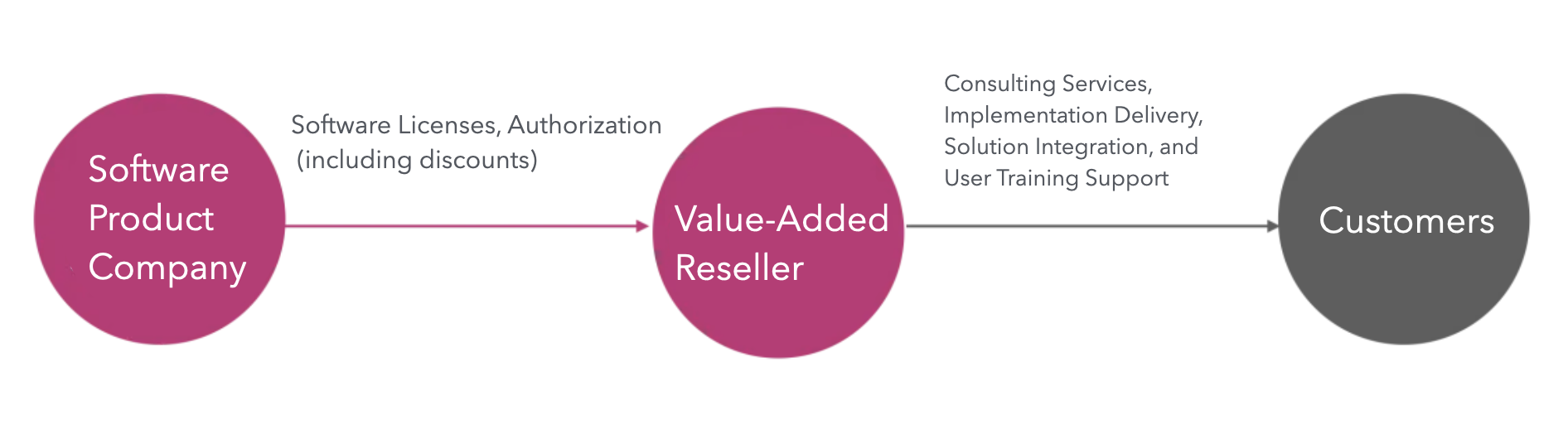

Distribution Partner

Distribution partners originated in the era of boxed software. Even as physical software distribution has disappeared, distributors (or agents) have taken on different focal roles, but the multi-tier channel model has been preserved.

In this model, distributors are authorized to develop the next level of sales in a region or industry, managing a branch of the product company’s partner network. They are also obligated to provide marketing support to the sellers in the network and technical support to end customers. They are also known as regional general agents.

Although distributor relationships still hold great value, in the software market, they are almost exclusively a patent of gigantic enterprises or multinational markets, solving their channel network management efficiency issues. For local software product companies, the multi-tier distribution model is rarely used anymore because the distribution process itself no longer creates additional value for end customers.

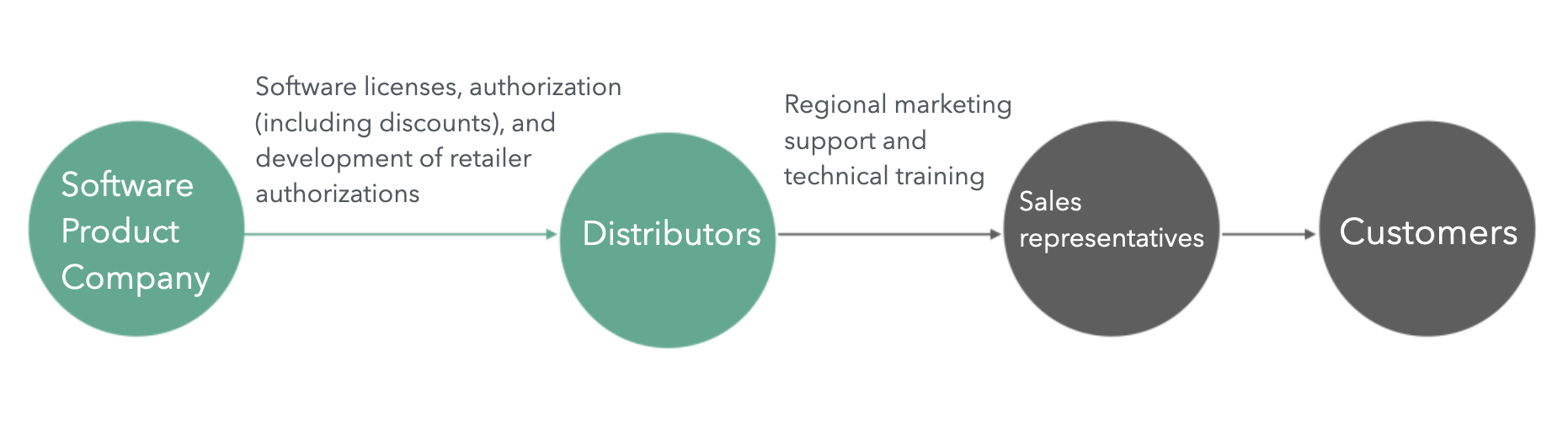

OEM Partner

In some cases, software products can be sold as part of other software products. The seller can set prices or completely absorb the cost of the OEM product as part of the overall product cost.

In the IT industry, typical OEM partnerships include the relationship between operating systems and computer hardware. In the purely software industry, databases, middleware, gateways, security products, and others are also commonly sold through OEM partnerships. However, a software company merely purchasing technology tools from another company, with no connection between the number of customers sold and the supplier, does not constitute a true OEM partnership. A real OEM partnership involves interests tied to the number of end customers sold, such as Microsoft charging OEM partner a fee for every PC sold with Windows licensed.

OEM partnerships also create certain value for end customers. At the least, customers save the cost of buying different products separately and integrating them on their own.

When selling OEM products, whether to conceal the original supplier’s brand (white labeling) is not a necessary condition for an OEM partnership. In fact, most OEM partnerships in the IT industry maintain brand independence. The issue of white labeling fundamentally depends on the bargaining power of both parties, their respective brand’s market impact, and end customers’ preferences.

Many technology products used by consumers and businesses contain a large number of software licensing commercial licenses. In most cases, end users do not care about these specific technical issues, so OEM Partnership is a widely existing channel model, although it is often not explicit. As an enterprise software manufacturer, efforts should be made to discover whether one’s products have the potential for OEM sales, as it is an effective way to quickly expand market share. After all, the world’s largest software company, Microsoft, also started by providing an OEM operating system for IBM PCs. However, startups often find it difficult to discover and pursue such strategies, partly out of a desire to build their own brand, and partly because establishing an OEM partnership is a business activity that involves high input and difficulty. It involves very complex technical verification, building trust with partners, and unavoidable bargaining processes.

System Integration Partner

The term “General Contractor” often heard in the industry refers to large clients’ commissioned general integrators. General integration is not unique to the IT industry. In any industry with complex project delivery, such roles may exist, including construction engineering, equipment engineering, and defense industry. General contractors are usually large enterprises with high commercial credit levels, operational and financial strength, and complete operating qualifications. They are entrusted by the client to manage and deliver a systemic complex project, usually establishing a relatively close relationship with the owner. The reason the owner entrusts a general contractor to manage complex projects is due to the large number of suppliers involved, and the client lacks the energy and professional skills to manage directly. Therefore, for original product service providers, it is not always possible to directly connect with system integrators; there may still be a need for small-scale integration by value-added sellers, thereby simplifying each transaction level.

In the IT industry, integrators are a significant force. They often cluster in industries where large organizations are concentrated, such as government, communications, energy, and finance. Companies engaged in IT technology products and services need to establish partnerships with important integrators to establish channels to these large enterprise customers. Especially for products aimed at large enterprises, if they cannot establish cooperative relationships with system integrators, they will never be able to penetrate the core customer group. Of course, integrators also need to research competitive product technologies in the market, master integration skills, to make the entire project construction and delivery smoother, and meet the needs of the client. The revenue of system integrators is composed of the difference in product services and their project management service income. Therefore, when system integrators choose products, they not only consider technical adaptability but also whether it can meet their own gross margin needs. If conditions permit, system integrators prefer to cooperate with stable and mature manufacturers in the long term to obtain greater batch price advantages.

Because integrators are involved in large projects, the project delivery process may also involve independent bidding service providers and supervision service providers to ensure the procurement and delivery process of the entire project is standardized.

Technology Partner

The technology partnership is an alliance relationship in the IT industry that runs parallel to commercial transactions. It is usually established between enterprises that use products collaboratively. For example, a typical technology partnership is the Intel x86 chip architecture and Microsoft’s Windows operating system. To ensure hardware and software systems run synergistically, hardware companies need to understand the hardware requirements of software applications, and software companies need to understand the hardware performance baseline and development trends. Therefore, partners mutually disclose information to establish a symbiotic ecosystem.

Besides hardware-software relationships, software-software partnerships also exist. For example, apart from Apple, most Android phone manufacturers are Google Android technology partners. These partnerships are relatively open.

In the enterprise software market, examples include the SAP HANA and Microsoft Azure technology partnership, and IBM and Apple collaborating on enterprise mobile application development. Currently, the hottest technology partnership is the comprehensive collaboration between Microsoft and OpenAI. OpenAI leverages Microsoft’s funding, search engine, and enterprise applications, while Microsoft’s product suite is enhanced with GPT technology.

Technology partnerships can sometimes be purely for PR, but high-value, high-impact technology alliances do exist. When the power of a technical alliance is unleashed, conventional market competition strategies are often unable to match it. Establishing valuable technology partnerships relies on a deep understanding of technology, market trends, and user needs.

Product Partnership

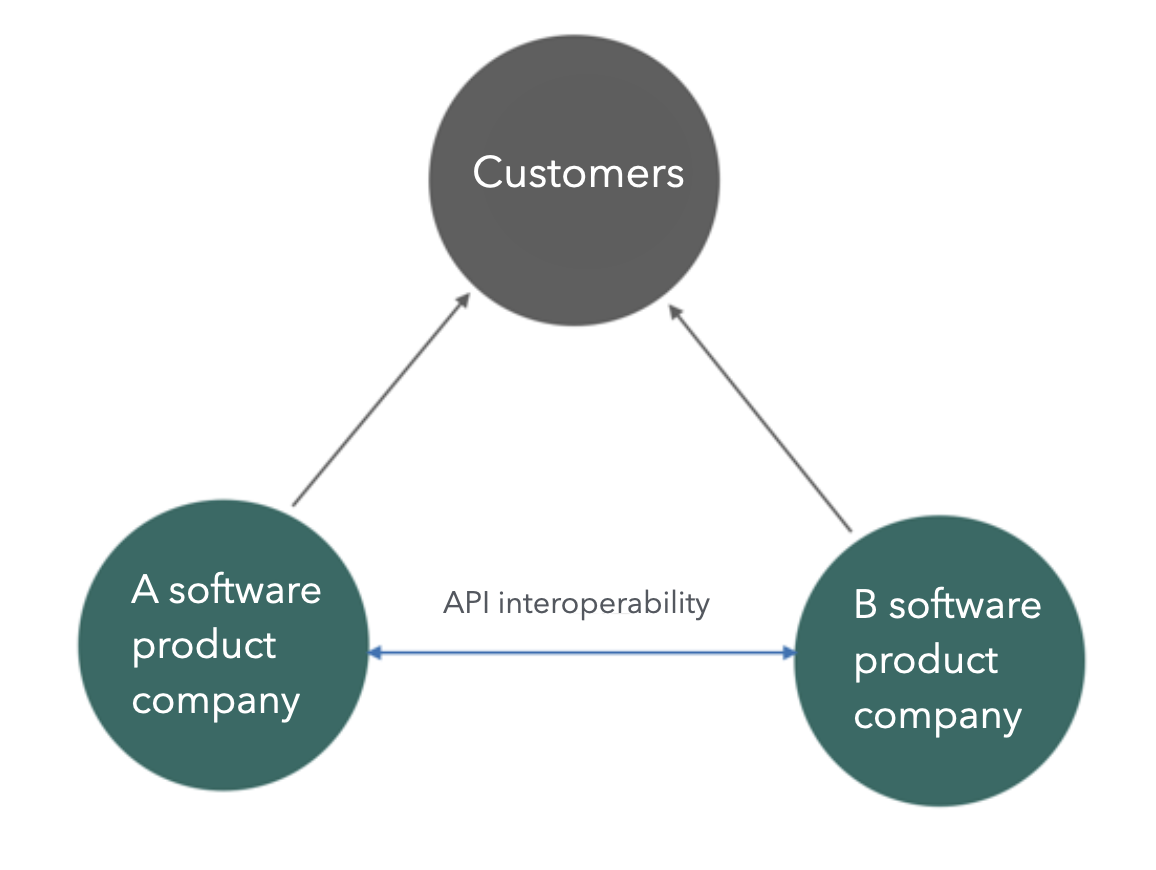

Product partnerships in the IT industry are relatively loose. They focus on establishing data interoperability between complementary products, allowing end customers to easily use both products together. They usually achieve product integration through embedded integration centers within the products, often using Open Auth protocols. Besides this, they may not have extensive collaboration in marketing and sales.

For example, a CRM application can integrate with an ERP product, synchronizing orders from the CRM system to the ERP system, while product lists in the CRM system are updated in real-time from the ERP system.

Product interoperability protects customers’ existing investments, avoids the complexity of using overly comprehensive suites, and reduces IT costs. For vendors, it allows more manageable product boundaries without making the product overly complex due to diverse customer needs. However, product integration is not always easy. Not all vendors provide high-quality APIs, and even if they do, manually completing data integration between products is labor-intensive. Therefore, integration platform products specifically offering data exchange between different products have emerged in the market.

Due to communication link limitations, such product integration relationships are usually only feasible between cloud products. On-premise software is less likely to achieve data interoperability through APIs easily. Product partnerships are common in the SaaS field. Most mainstream enterprise SaaS products have embedded integration centers for connecting with other applications.

Conclusion

Our industry is particularly complex, with many terms and concepts that are easily obscured. This article aims to help readers identify valuable information while reading industry news and categorize the meanings behind commercial activities. Partnerships are not just PR activities; they are essential drivers of industry development. For product technology companies, developing effective partnerships can elevate business operations to the next level. Nocoly HAP, engaged in the APaaS product field, focuses on developing value-added business partners, establishing cooperation with system integrators, and developing mutually integrated product partners. Through this article, I hope to connect with more industry friends and become partners for mutual growth and success.